Dive into the world of PAYE investigations. Uncover the facts, implications, and insights in this informative blog

The Chancellor of the Exchequer Rishi Sunak has presented his 2022 Spring Statement on 23 March 2022. Key points include an increased national insurance threshold, 1p income tax cut, employment allowance being raised, and fuel duty cut by 5p per litre. Other highlights are the Zero rate VAT for solar panels and the new Public Fraud Authority.

£2,700 Increase In National Insurance Threshold

Chancellor Rishi Sunak has announced plans to raise the national insurance threshold by £2,690, in a move that sees taxpayers receive some respite in the Spring Statement.

The threshold increase from £9,880 to £12,570 will start on 6 July 2022. The equalising of NICs and income tax thresholds for the first time could suggest a potential merger of income tax and NIC into a single threshold.

Sunak said: “The current threshold for national insurance is £9,500 and I will increase this by £3,000 – equalising the NICs and income tax thresholds from July 2022. This is a £6bn tax cut for 30 million people and is the largest increase in the basic rate threshold ever. It is a tax cut that rewards work.”

The threshold changes will see an average tax cut of £330 per worker, effectivity balancing out the new health and social care levy for employees, which is due to commence on 6 April 2022 but was announced on 7 September 2021.

The 2022-23 tax year will see a total saving of £267 for those earning £20,000, and £142 in the year for those earning £30,000. Anyone earning £50,000 a year salary will pay £108 more when taking both of these tax adjustments into account.

Lower earning self-employed individuals also saw a benefit from the Spring Statement. Self-employed individuals with income falling between the Small Profits Threshold and Lower Profits Limit will not pay any Class 2 NICs but will continue to build up National Insurance credits.

The Primary Threshold (PT) for Class 1 NICs and Lower Profits Limit (LPL) will increase, from 6 July 2022. This will align with the personal allowance for income tax, currently set at £12,570. This rate will remain fix until the 2025-26 tax year. The PT and LPL will increase in line with the Consumer Price Index (CPI), from the 2026 -27 tax year onwards.

Gary comments: ‘The Chancellor has again shown reflexion to media noise about taxpayer income pressures and, despite a difficult economic backdrop, was able to give tax relief to lower income taxpayers. I imagine that future tax policy will focus on the large multinational consumer taxes and new rates for the higher earners and whether they can push over the psychological 50% cumulative tax rate.”

1p Income Tax Cut In 2024

Long-term plans to cut the basic rate of income tax from 20% to 19% by 2024 were also announced by Rishi Sunak in the Spring Statement.

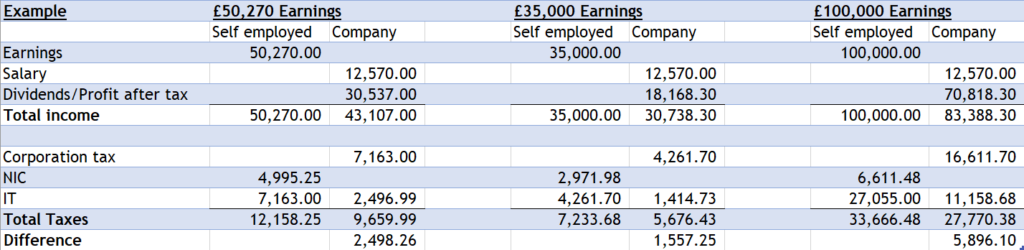

Gary comments “Is this a coincidental match to the 19% corporation tax rate and claiming back taxes from those no longer in employment? A quick calculation shows a tax saving as a company versus a sole trader around £1,550 at an income level around £35,000. So, this remains the minimum income threshold we recommend to incorporate a company after accounting for other compliance costs like accounting fees. An income of £50,270, the higher rate threshold, shows a tax difference of just under £2,500 and at £100,000 the tax difference is £5,896.”

The Chancellor of the Exchequer states that the tax cut will affect around 30m people who are taxed at the basic rate in England, Wales, and Northern Ireland.

The income tax rates in Scotland are devolved, but Rishi Sunak stated that the Scottish government’s funding is automatically increased, initially worth £350m in 2024-25, as a result of the basic rate of income tax cut.

The statement also claims in 2024-25 the average taxpayers’ take home pay will increase by £175 annually, in 2024-25 the 1p cut to income tax is set to cut tax overall by £5.3bn, in 2025-26 it will be cut by £6bn and in 2026-27 it will be cut by £5.9bn mostly for the lower earners.

Employment Allowance Raised To £5,000

Sunak announced that commencing from the new tax year, there will be a 20% rise in the employment allowance. The increase in employment allowance is aimed at supporting business.

The measure will see the employment allowance rise up to £5,000 from £4,000, an increase of £1,000. This will be in effect from 6 April 2022 and for qualifying employers.

Businesses will have the capacity to employ four full-time employees, and pay them the national living wage, without having to pay the employer NIC.

Around 495,000 businesses may benefit from the new measure, an additional 50,000 businesses may not have to pay NIC and the health and social care levy entirely. From April 2022, a total of 670,000 businesses will no longer have to pay NICs as well as the health and social care levy because of the employment allowance.

5p Per Litre Cut In Fuel Duty

The Chancellor has cut fuel duty by 5p per litre across the UK since 6pm on the release of the statement due to a stark and unforeseen rise in petrol and diesel rates. Rishi Sunak has stated that the fuel duty cut will be in place for at least 12 months.

Zero rate VAT for solar panels

The chancellor looks to remove VAT from investment in solar panels and heat pumps, with a view to address the energy crisis, yet has held back from offering grants.

The government will expand the purview of VAT relief available for energy saving materials, with a view to help households improve energy efficiency and reduce heating bills.

The relief will include investment in solar panels and wind turbines, people who have energy saving materials installed in their homes will pay 0% VAT on the materials. The current rate is 5%.

The zero rate VAT scheme will run until March 2027, starting from 1 April 2022.

Public Fraud Authority announced

The Spring Statement announced the creation of the Public Sector Fraud Authority, a new public body that is aimed at combating the UK’s ‘fraud epidemic’.

Spring Statement: £161m funding for HMRC compliance work

A further £161m in funding will go to the HMRC over the next five years, to improve compliance and its debt management capability.